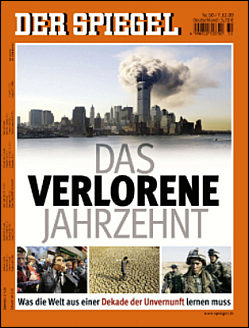

The reviews are in and it is clear that this was a decade to forget. For Der Spiegel, it was "the lost decade" (das verlorene Jahrzehnt). For Time Magazine it was "The Decade from Hell". Few will mourn the end of "die Nullerjahre" (the "aught-years").

Looking back, it is hard to believe that the decade began with a feeling of tremendous optimism. The Berlin Wall had collapsed and the Cold War was finally over for good. For Francis Fukyama it was "The End of History". Liberalism had triumphed and it was up to the technocrats to fine tune the endless prosperity to come.

But very soon the optimism vanished as the new era was transformed into "the Bush Decade", beginning with a stolen election of 2001, No need to go into the serial disasters of the presidency of the George W. Bush: Juan Cole has listed the "Top Ten" calamities of the Bush Decade. Suffice it to say, America and the world will be dealing with the legacy of corruption and incompetence for years to come.

But the Bush era also ushered in the "Goldman Sachs Decade". The decade began with the Dot Com meltdown where firms taken public by Goldman vanished into cyberspace while the firm pocketed $billions in underwriting and "restructuring fees". And Goldman Sachs is ending the decade with an explosion of profits as it profited from the greatest financial meltdown since the Great Depression. The New York Times has detailed on how Goldman pocketed $$billions in fees by selling toxic securities to its clients but made many $$billions more by betting against their own clients with complex hedges. Paul Krugman summarizes:

Even as the dot-com bubble deflated, credulous bankers and investors

began inflating a new bubble in housing. Even after famous, admired

companies like Enron and WorldCom were revealed to have been Potemkin

corporations with facades built out of creative accounting, analysts

and investors believed banks’ claims about their own financial strength

and bought into the hype about investments they didn’t understand. Even

after triggering a global economic collapse, and having to be rescued

at taxpayers’ expense, bankers wasted no time going right back to the

culture of giant bonuses and excessive leverage.

But it all could have been much worse and there are signs of hope. The same doom-and-gloom assessment in the Spiegel article ends with a some positive comments about the future of Europe and the European Uniton which is "slowly becoming a true political community of nations. Europe could be a model for the world "(«allmählich eine politische Gemeinschaft von Staaten» entstehe. Europa könne «ein Vorbild werden für die Welt».) And, under new leadership, the US is rejoining the community of nations as it grapples finally with the myriad problems left over from the Bush Decade.

And let us not forget: the "lost decade" also saw the emergence of blogs as an important new medium.

0 comment

Thanks for the thoughtful commentary, which I am linking to.